For the last 30 years the organisation Christians Against Poverty has worked with local churches to help people struggling with debt and money worries. That help is needed more than ever with statistics showing 15 million people face daily anxiety about their finances, with January being one of the most worrying times.

Over the next few months several churches in our diocese are running CAP Money Coaching courses to offer support and guidance to those facing money troubles. Here’s how some of our churches are helping adults and children with their money skills and showing the love of God through their work.

Parish of Basingstoke Down

The Parish of Basingstoke Down has been running CAP Money Coaching courses for 10 years and now works with churches and schools across the town to help people manage their finances. The free course for adults offers budgeting hints and tips and is open to people of any faith or none.

“We believe that it’s a fundamental part of the church’s job to help people in need in practical ways, as well as spiritual ones, to show God’s love at work,” says Jon Morris, the parish’s Money Coach Lead.

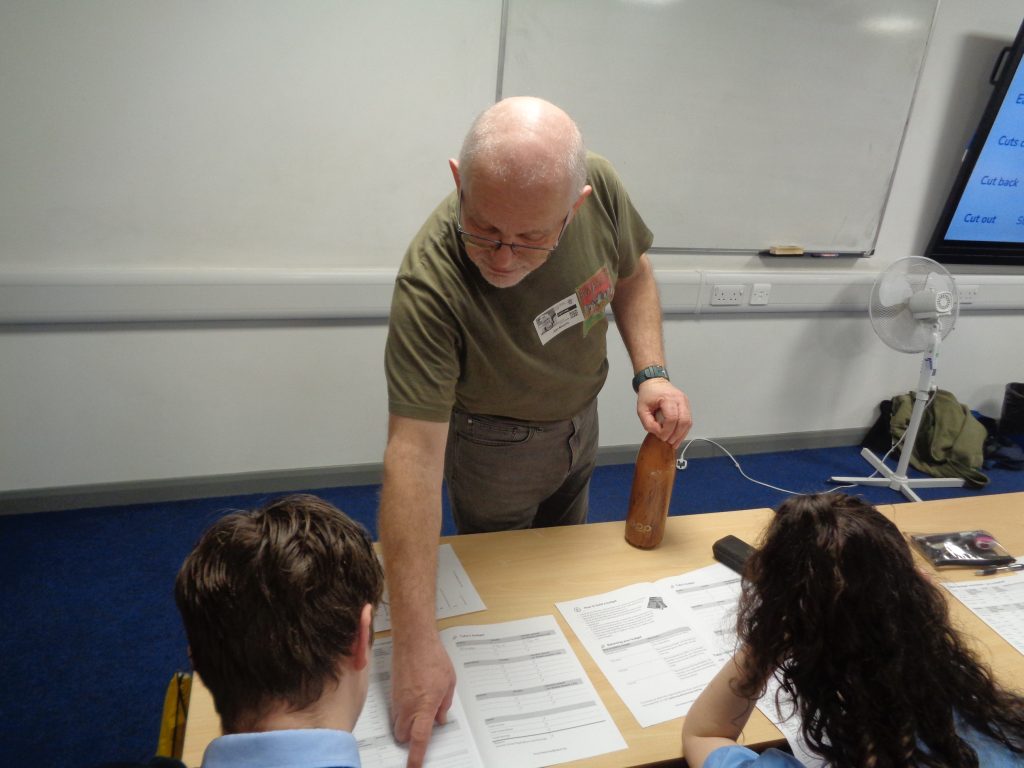

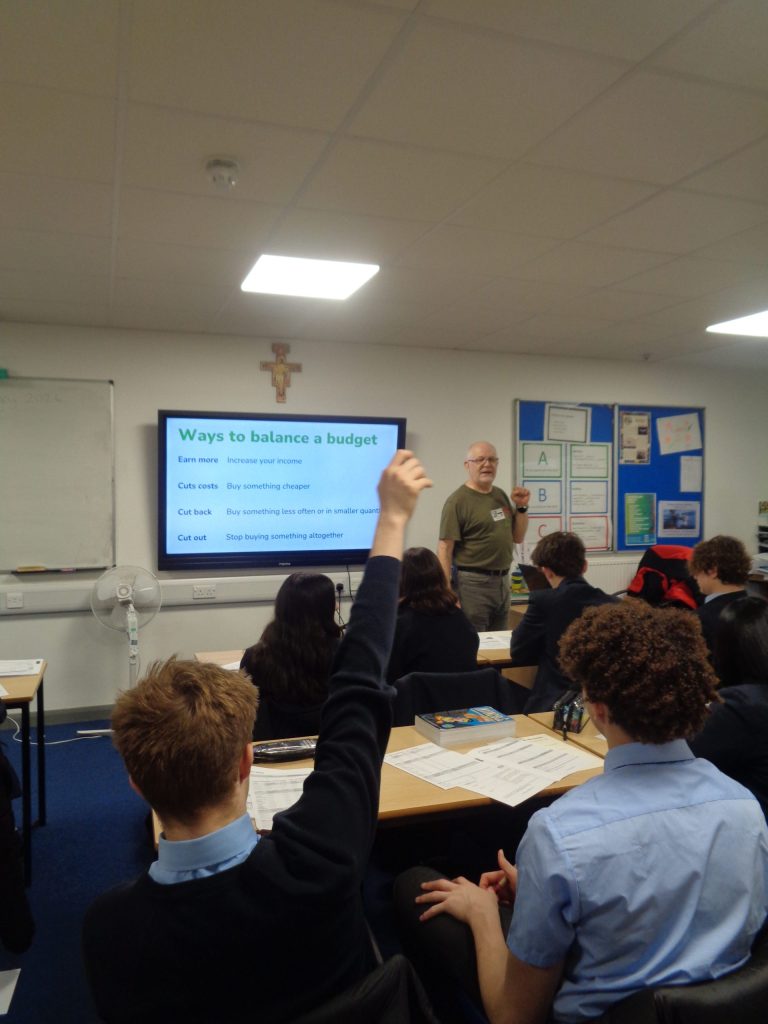

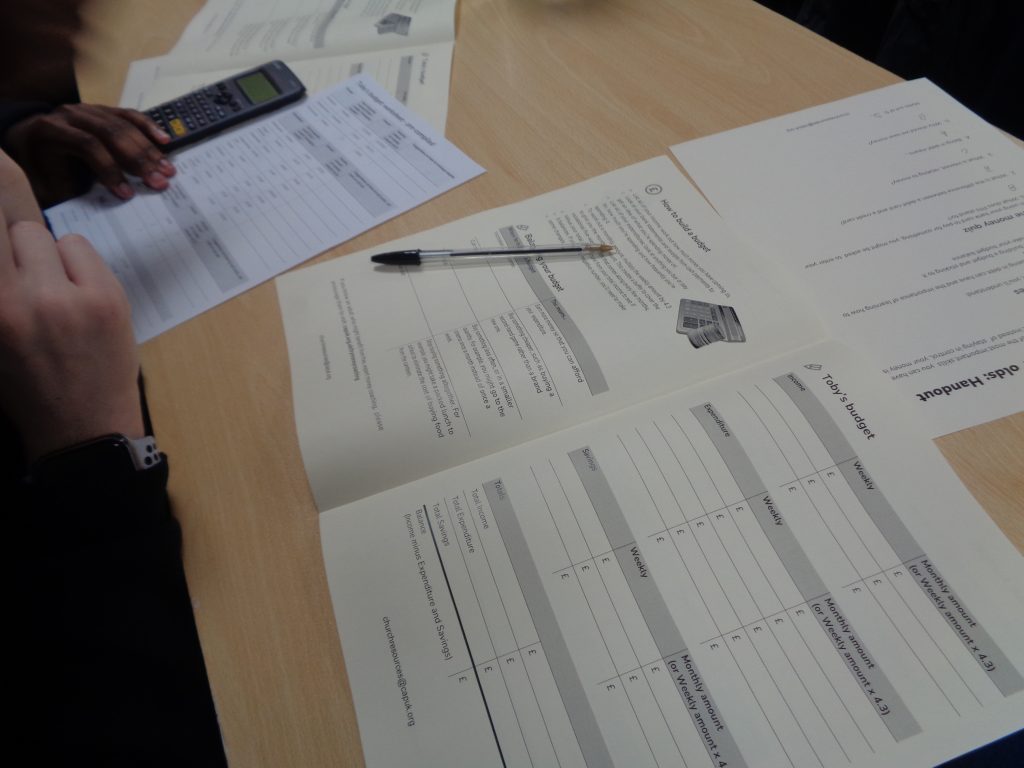

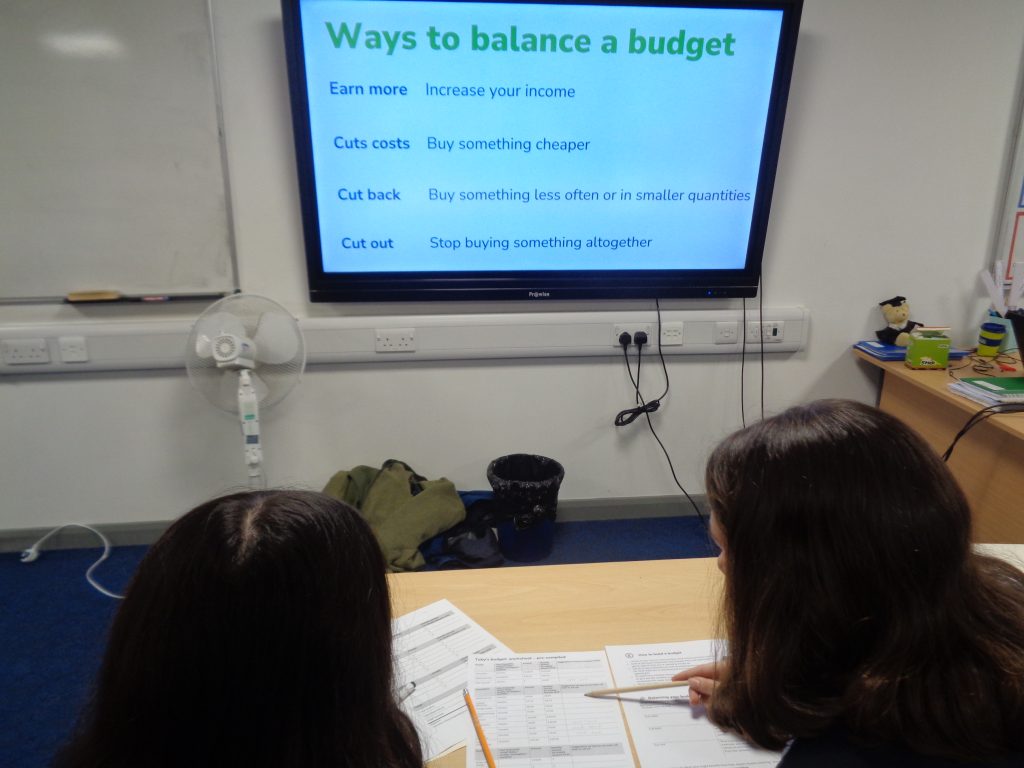

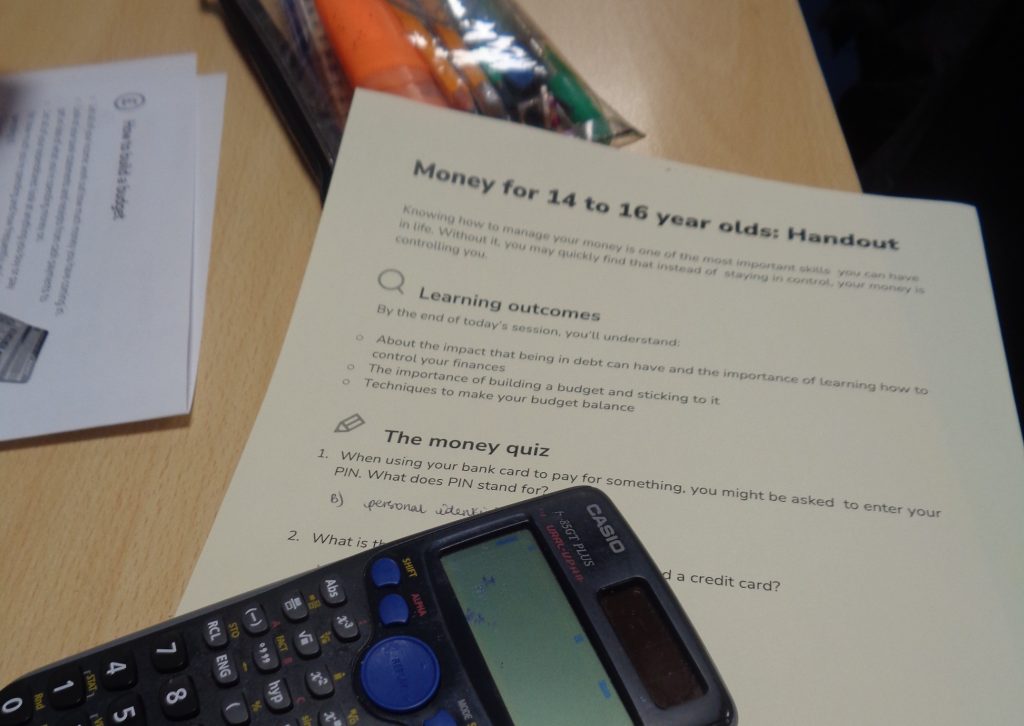

Alongside its adult courses, around 5 years ago, Basingstoke Down was one of the first parishes in the country to start courses for school pupils. A team of volunteers run CAP Money Youth for pupils of Year 11, and CAP Money Kids for pupils of Year 6. It introduces the idea of budgets, income, expenditure and savings and how to ‘cut cost, cut back, cut out’ until it balances.

The pupils are shown a film, given practical examples and exercises on how to create a budget and consider their own finances. The church has a vision to take this course into every school in the town, to ensure children have a basic grounding in budget skills.

Judith Boyd, PSHE lead at Bishop Challoner School, said, “I think for us it’s particularly valuable because we can create a foundation of Christian perspectives on money and stewardship and taking care of your resources, which helps our students understand how to be responsible and how to live a life without debt.”

16-year-olds Ansteena and Jairus said they learnt a lot from the course. Jairus commented, “I want to study finance at University, so I think it’s good to learn about your finance young so you can understand more as you grow and I feel more prepared.”

Ansteena added, “I didn’t realise how much I was spending until it was physically in front of me. It’s made me more aware about how I should spend my money and what things I should cut out. In the future, I’ll definitely remember this and take note on how much I’m spending.”

The Money Coaches have been trained by Christians Against Poverty, which is regulated by the Financial Conduct Authority. They provide materials for the volunteers to use in the courses.

The team from Basingstoke Down also works closely with the CAP Debt Centre at Mosaic Church and is also partnering with other churches across the town to deliver the course.

Jon continued, “Churches often meet people who are in need, in their toddler groups, in their mums’ groups, in their men’s groups. They can find people and say, ‘we have this organisation that will help and it’s free’.

“We believe it’s part of God’s mission to see all his children cared for, loved and looked after. The church has an opportunity to stand up and show God’s love to people by offering this help. We always orientate that around a meal followed by the free money coaching to help people get back in control of their finances.”

Over recent years, there has been a growing need for help. More schools are now asking for a visit, and the parish is running more adult Money Coaching courses. Referrals are made by local food banks and community pantries.

Jon added, “There was a man called John who came on our adult Money Coaching course. His hope was to be able to go on holiday, but he couldn’t afford it. Two years later, I bumped into John in the local supermarket and he told me he’d just booked his holiday. He’d been following the principles that we’d given on the adult coaching course, and he’d been able to save up and take a holiday for the first time for 12 years. We also had a single parent who paid for Christmas for the first time after she’d been on the course as well. If we can help people learn how to budget, it can genuinely transform their lives in small ways and large.”

Basingstoke Down start their next adult coaching course in March. Jon is happy to talk to other churches who are interesting in setting up their own CAP money courses. He can be contacted at: money.course@parishofbasingstokedown.org.uk

LOVECHURCH, Bournemouth

A CAP debt centre is run out of LOVECHURCH Bournemouth. The team offer support and befriending and are able to access expert debt advice from CAP head office such as repayment plans. The church also offers the CAP Money course to give people the skills, tools and confidence to better manage their finances.

Charlie Lavin, Debt Centre Coach and interim Debt Centre Manager said, “the idea is that we are able to essentially bring freedom through the money courses and the Debt Centre but also be able to bring them Jesus. By being grounded in a local church, we can invite people along to church events and get to know people in the wider community. They’re not just seeing us as the people that work for CAP, but we get to welcome them to something more.”

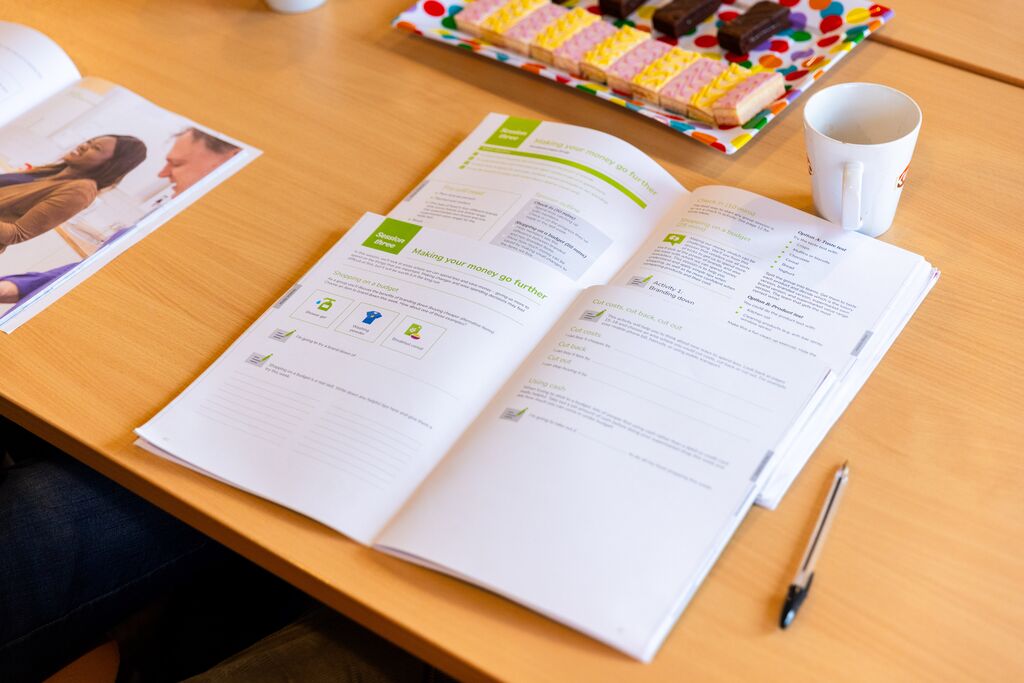

The three-week course gives tips and ideas on how to save and uses an online system to help participants build their own budget. It’s also an opportunity to ask questions, chat to others and to share experiences.

Charlie continues, “We ran a course for students in October. One of the questions for people who came was, ‘what is a budget?’ It wasn’t that they’d been taught bad money habits, it’s the fact they hadn’t been taught any money habits. They just guessed or maybe they picked up things that their parents had done. Once you hit 18, and you suddenly have more money, it can be a bit of a minefield. It’s a really accessible course to commit to and learn about themselves as well.”

The church has seen a rise in need for help from across all backgrounds and generations. Last year it helped local people clear £82,000 worth of debt.

“What a weight that is for those people. I think it’s more life-changing than people think,” Charlie continues. “When you’re in debt, there can be so much shame. A lot of people won’t even tell their friends or their family, and you’re the first person that they’re telling. I think as a local church, we have such an opportunity to stand alongside somebody and not judge them and to just love them.”

As part of the ‘Love your Neighbour’ initiative at the church, many who had accessed the CAP help were given Christmas boxes last year.

Charlie concluded, “Sometimes it almost feels like normal to be in debt. In a sense it’s socially acceptable in some ways. We get to say, ‘no, there’s a different story’ and we get to be a part of that transformation. I think it’s huge for people to release that burden.”

Andover Parishes

Andover Parishes describes their CAP Money Coaching course as an ‘MOT on your finances’. The course is held 2 to 3 times a year with courses also taking place at the local job centre. The church’s Debt Centre also offers face to face support, backed up with advice from CAP head office.

Roger was helped by CAP Andover and now volunteers his time to help others. He said, “When my wife died, I didn’t know where to turn so I turned to CAP and they helped me get out of financial difficulty and I am now completely 100% debt free. It was huge. You have that nag in the bottom of your stomach thinking ‘how am I going to pay all this lot off and how am I going to do this?’ and then suddenly you are debt free. It really does lift you just to know that.”

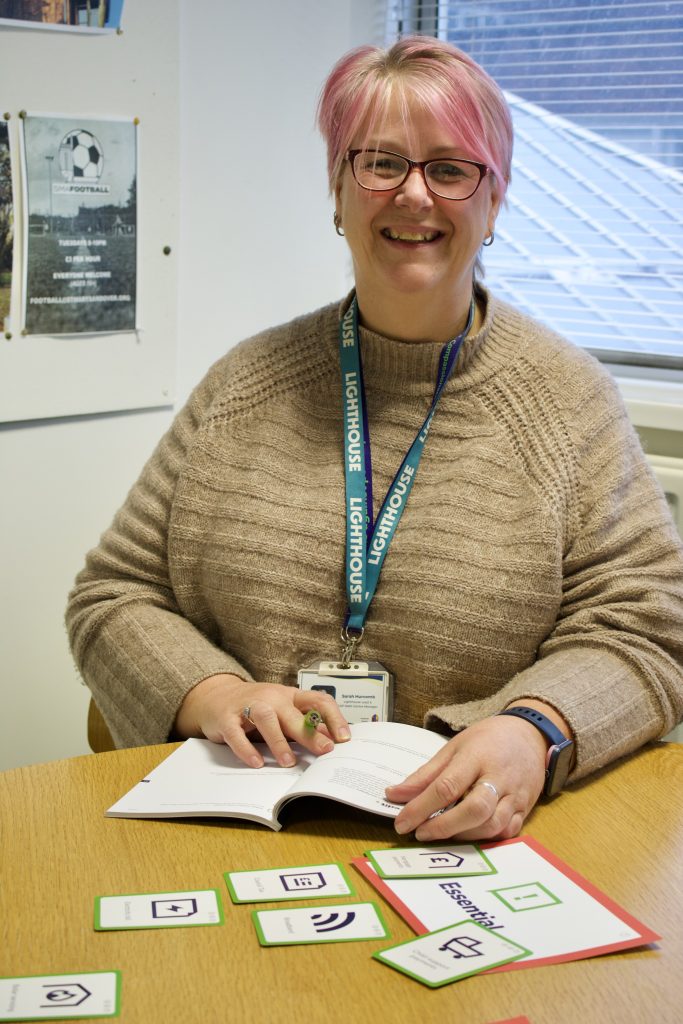

The money coaching session runs over three weeks and introduces the online tool to give a better understanding of how to build a budget, having separate accounts for bills, savings and the weekly spend. There’s talk about the three Cs – cutting costs, cutting out, and cutting back and looking at what’s essential in life and what’s optional, which can cause some debate!

Sarah Hurcomb, Lighthouse Lead and CAP Debt Centre Manager in Andover Parish, said, “There’s quite a lot of discussion and thinking about their own situation. When we come to the third week, hopefully the budget has been balanced. There are usually stories of where individuals have made changes and have empowered themselves to go and make those positive choices in working their budget out.”

The church works alongside Andover Food bank and primary care networks and receives referrals from other external agencies such as housing. It’s part of the church’s Lighthouse initiative, offering support to people in the Andover area, including a community drop-in space, bereavement courses and Kintsugi Hope wellbeing course. It also works with a charity for young people ‘You Matter’ offering budgeting courses.

Sarah continued, “We have found that as time’s gone on, other agencies really respect what we do. We’ve got a good reputation within the town of loving people and coming alongside. It’s not a hard preach. It’s very practical support where someone needs it, with the Christian message alongside.

“We build up a real relationship with the clients and are able to invite them along to church. I always offer to pray with people while we’re doing the visits, and most people are open to accepting prayer. I’ve even had people ask for prayer. So, there’s that exposure to Christianity and the hope that we have in Christ, whilst offering a very practical solution of debt advice. Knowing that they’ve heard the gospel through our message, through our very practical support, that might be the only time they hear or experience God’s love through a practical way.”

People often reach out to churches or to church initiatives when struggling with debt – below are a few organisations to direct people to, which can offer support: